child tax credit 2021 dates and amounts

The tool below is to only be used to help. 13 opt out by Aug.

2021 Child Tax Credit Advanced Payment Option Tas

The credit is calculated by taking 15.

. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. For tax year 2022 the Child Tax Credit returns to pre-2021 amounts. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. 15 opt out by Aug. The credit returns to 2000.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 600 in December 2020January 2021. 3600 for children ages 5 and under at the end of 2021.

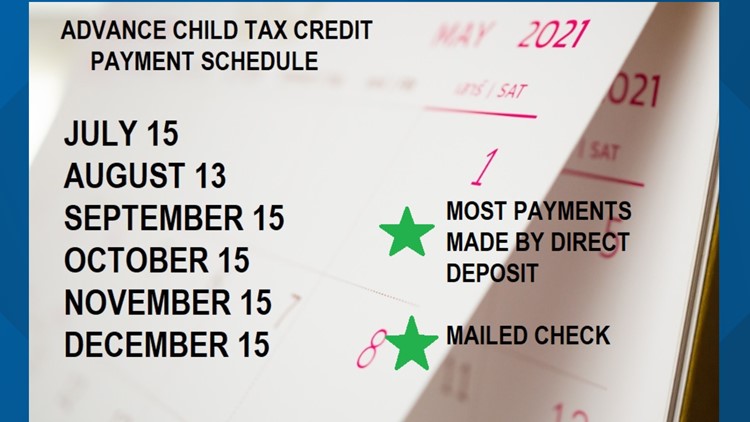

Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022. New 2021 Child Tax Credit and advance payment details. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Please be aware that your children need to be under 18 years old or 6 years old if you are looking at claiming up to 3600 at the end of the 2021 tax year to be eligible for the. 3000 for children ages. The credit amounts will increase for many.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. Of the 2000 1500 is refundable.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. For 2021 eligible parents or guardians can receive up to 3600 for each child who. This means if your have no.

This credit is refundable for the unused amount of your Child Tax Credit up to 1400 per qualifying child depending on your situation. Your amount changes based on the age of your. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont have to repay any child tax credit. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17. Child Tax Credit decreased.

Child Tax Credit amounts will be different for each family. 1200 in April 2020.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kabb

What To Know About The New Monthly Child Tax Credit Payments

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

The 2021 Child Tax Credit John Hancock Investment Mgmt

Child Tax Credit Updates What Time What If Amount Is Wrong

Taxpayers Now Can Go Online To Opt Out Of Advance Child Tax Credit Payments Verify Eligibility Don T Mess With Taxes

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Advance Child Tax Credit Payments Begin July 15

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

The Child Tax Credit Research Analysis Learn More About The Ctc

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center